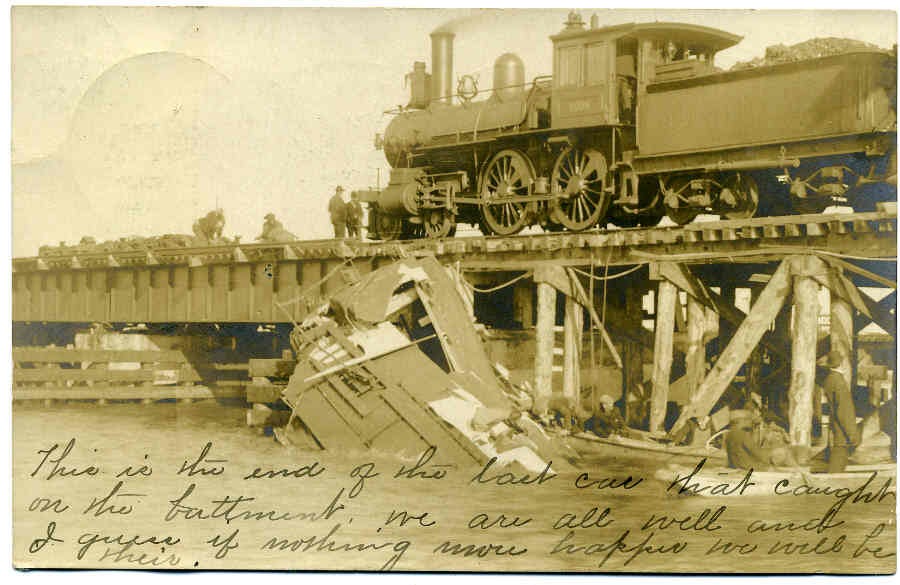

In 1906, Pennsylvania Railroad issued a statement to offer an explanation of what had happened in a train wreck that had left more than 50 people dead. The statement was intended to deny misleading information spread and amplified by the public’s unrest and deliver an accurate account of the catastrophe, later known to be the world’s first press release. It was printed by the New York Times and disseminated to the public in a timely and effective manner.

Wreck on Railroad the Pennsylvania, 1906

This established a new normal of public relations campaign that is still seen today. Not only does press release provide an opportunity for you to guarantee that information be shared correctly, but it is an important channel to attract the attention of the news media to a newsworthy item of information. Press release also evolved as a marketing tool that often generates a higher return on investment than traditional mode of advertisement. While your ads on Google may cost you hundreds of dollars every month and end up being disregarded, your press release that catches journalist’s eye turns into an invaluable article which readers perceive as a meaningful piece of information.

Few journalists today visit your website in search of breaking news. They bookmark websites of press release distributors, for example, PR Newswire or Business Wire, a platform where journalists meet new story. Bland as the user interface look, it serves the purpose so long as journalists are concerned and after all, is not intended for the general public except diligent investors in the hunt for next multi-bagger stocks.

Beyond Press Release

PR Times (3922.T) is on a mission to dispel the boring image of press release platform. In addition to basic features with extended media coverage, it allows clients to post multi-media press release including short videos which is then delivered to the wider audience out of journalist community. PR Times generates a whopping 90 million monthly PV as of August 2023, bolstered by close to 500,000 followers in total on X. To put it into perspective, PR Wire and At Press, the second and third largest press release distributor in Japan, have about 20,100 and 10,100 followers respectively as of October 2023. The unparalleled consumer presence of PR Times pins down its unique positioning away from traditional intermediary between businesses and the news media towards direct marketing platform.

Major Press Release Distributors: Number of Followers on X as of October 23, 2023

It is never an easy job to gain wide publicity particularly among consumers, as on top of everything, contents need to be made approachable for the general public. With this regard, PR Times has a dedicated team from advertising firms to provide content advisory. In the absence of such capabilities, any effort to build consumer presence may end in vein, instead proving the deep moat PR Times has established to date.

100 Million Club

Against this backdrop, the KPIs to which PR Times and its investors pay attention are not so much traditional metrics such as media coverage represented by the number of media partners as page view on its owned media and the number of followers on X. As the chart below shows, the number of followers on X has quadrupled since 2020, and despite a slowdown over the past three quarters, our latest check suggests that it is set to deliver a 6% QoQ growth this quarter ending in November 2023. Combined with the year-end seasonality that should send the following quarter even higher, we expect to see improved investor sentiment coming out of the recent slump. Another trend we observe is that what we call PV conversion, page views divided by the number of followers on X, has inched up over the past two quarters, implying an enhanced level of network externality at play.

PR Times: Number of Followers on X and Its Conversion to PV

In April 2021, the management envisioned 110 million monthly PV by February 2026, while our base case estimate based on the latest trajectory indicates that the then ambitious goal is likely met one year earlier than schedule. This also means that PR Times is only one year away from the “100 Million Club”, the presence enough to be considered mass media such as Yomiuri, Asahi, or Mainichi.

PR Times: Monthly PV

Deep Penetration

“Instead of Public Relations Team, Marketing Team is now responsible for press release about products” told Moe Otani, a marketing specialist at Family Mart, the second largest convenient store brand in Japan. It issues more than 20 releases every month on PR Times to capitalize on the strong consumer reach of the platform. Similarly, Japanese companies especially from consumer sector have adapted their approach to the changing nature of press release. As of August 2023, PR Times have penetrated into 55.6% of the listed companies in Japan, a 17% share gain since 2020, not to mention a fat tail of small-to-medium sized enterprises. The chart below shows historical numbers of total client since 2020.

「ファミマらしさ」を伝え続ける。マーケ担当が手がけるプレスリリース

PR Times: Number of Total Clients

As is the case with most growth companies, however, growth rates have come off quite a bit since 2021, leading to major multiple contraction until today. Unless we can make a strong case of re-acecleration of the client number growth, it is hard to resist gravity weighing on growth stocks today no matter how resilient their growth is.

More Value for Money

Nonetheless, our thesis here goes that PR Times has a lever to pull, or is about to pull - increase price. It has two plans at present, a sprinter plan that costs JPY 30,000 per release and a subscriber plan that costs JPY 80,000 a month for up to 30 releases. In our base case, we expect PR Times to raise price for both of the plans this winter for the following reasons.

First of all, the increasing value for advertisers warrants a higher price. As discussed earlier, PR Times rolled out marketing campaign since last year and successfully reaccelerated the growth of page views. As the client number growth has been smaller on a relative basis, page views per release have increased significantly from 2,181 PV last year to 2,885 PV today, and is expected to grow further down the road. Clients must have observed improved publicity of their press releases on PR Times by looking at dashboard to monitor their media exposure. The enhanced attractiveness as a marketing platform translates to stronger negotiation power lying with PR Times.

PR Times: Average PV / Release. Note that the spike in early 2020 was due to softened marketing activity in the wake of COVID-19

It is also worth noting that PR Times announced in July 2023 that it would undergo a thourough revamp of its platform, the largest project ever since 2016. The overhaul is expected to significantly improve user experience, centered around AI mounted editor and templates. We believe that this project gives PR Times a good reason to negotiate a higher price in exchange for improved value proposition, and we are likely to hear the news in the next quarter when the project gets complete.

サービスの未来を左右する大規模リニューアルを、包み隠さずオープンに。PR TIMES、「透明性」を軸に据えたリニューアルプロジェクト始動

21% Room

You may wonder - Is it even acceptable to negotiate a higher price in Japan where price has generally fallen over the past decades? That is a reasonable question as there are still many companies in Japan which are constrained by either the competitive environment or a potential threat of substitute products, and end up with an even lower margin due to higher input price.

However, that has proved not the case at least in the SaaS space. We have witnessed a dozen of price adjustment announcements from, for instance, Chatwork, freee, or Uzabase. What is most encouraing for us is that PR Times itself has also increased price last year for another product called Tayori by 12% and 27% depending on plans, adding up to our conviction.

Tayori、価格改定のお知らせ スタータープラン/プロフェッショナルプランで11/1より

PR Times: Tayori’s Announcement to Increase Price After Platform Revamp

As laid out earlier, PR Times offers a sprinter plan and a subscriber plan. While the breakdown is not available, our calculation suggests that each accounts for 70% and 30% in revenue. As the majority of the revenues from the former plan presumably comes from SMEs with limited marketing budget, PR Times cannot afford to lose them and therefore, may well execute a modest price increase. Our base case asssumes a 17% increase to JPY 35,000, which is slightly more expensive than market at around JPY 30,000 but may well be accepted given attractiveness of the platform.

It is in most cases more cost effective for public clients to subscribe to the latter plan, which in our view can accommodate an aggressive price hike. Currently, the plan costs JPY 80,000 a month and allows subscribers to post up to 30 releases. According to our back calculation, each client posts 9 releases on average today versus 6 releases in 2020, implying increased usage or so to speak, willingness to accept a higher price. Our base case assumes a 25% increase to JPY 100,000 a month, suggesting a blended price appreciation of 21%.

Operating Model

We are now ready to discuss our revenue model. Our base case assumes the number of clients to grow in line with the historical and the price increase to become effective in the next fiscal year, resulting in a mid-thirty year-on-year revenue growth. For those skeptic about the price adjustment, the top line with the current price points would still grow at around 14% YoY, enough for downside protection against our thesis.

While PR Times does not disclose the composition of COGS, we think it reasonable to model it against page views which dictate the server capacity. Remember that our check suggests that page views will most likely grow faster thanks to more followers on X, which in exchange weighs on server capacity. This would be another significant force to push for price increase to protect gross margin. Speaking of marketing spend, we follow the company’s guidance for this fiscal year, and expect a similar level of budget in the following. Other lines of cost are extraporated from the past trend, while we believe that a bull case could argue more room of margin improvement through operating leverage. Overall, our cost model suggests that operating profit margin is reaching north of 30% in the next fiscal year.

Plan or Target

The table below shows a summary PL. As highlighted in yellow, we expect operating profit this year to land at around JPY 1.5 billion, in line with company’s guidance, and next year to record approximately JPY 2.9 billion that wildly beats the latest guidance of JPY 1.9 billion.

While the delta may look outrageous at face value, we would like to draw your attention to the company’s slide below, which shows a FY25 operating profit “target” ( 目標 ) by the red bar, separate from “plan” ( 計画 ) represented by the blue bars. Based on price actions to date, few investors have taken the target seriously as margin has deteriorated over the past quarters, but given the more recent positive momentum with business fundamentals, isn’t it high time to revisit the target and ask - What on earth is behind that number? Our answer to that is price negotiation, and our FY24 operating profit estimate of JPY 2.9 billion bridges a leap towards the FY25 target which otherwise would stand out alone.

PR Times: Presentation from FY23 Q2 Earnings Result

Another reason we like PR Times is its cash conversion model. As it receives a slew of prepayment from subscription, the net working capital is as compressed as only 1-3% of annual revenue, leaving a pile of cash on balance sheet. With cash balance standing at 70% of the total asset, share buyback may soon be on the table to lever the balance sheet up. In our model, return on equity is expected to hit 20% this fiscal year and 27% the following in the absence of new shareholder return program such as buyback or dividend.

Escape Velocity

PR Times used to trade at 70x NTM P/E in 2020, and has since downgraded to 20x over time. The multiple contracted significantly in April 2022 when the company delivered guidance for the coming year, expanding marketing budget at the expense of operating margin deterioration. It took more than a year for investors to confirm the traction of page view and follower acquisition, leading to bottom-out of valuation at 20x in July 2023. Share price has been hamstrung by gravity that weighs ubiquitously on growth stock, a force that sent Mothers Index from 860pt in June 2023 to 620pt in October 2023, but we believe that it would be able to reach escape velocity with an announcement of price increase.

Our projection has a FY24 diluted EPS of JPY 145, and a 20x forward P/E, the lower end of our expectation, implies a target price of JPY 2,900, 72% upside from the current trading as of October 24 2023, with risks skewed towards further upside through multiple expansion.

Risk

The biggest risk to our thesis is that PR Times passes on price increase this winter. While we believe the chance of the increase is fairly high for the reasons elaborated earlier, our downside case, which is not reflective of the price adjustment, implies a FY24 diluted EPS of JPY 88 and a target price of JPY 1,765 with the current forward P/E of 20x. This still poses a 5% upside potential, and as such, we would like to stress that this risk is material only to our thesis, not to this stock in its entirety.

Another risk is to let go portion of sprinter clients after increasing price points. As discussed earlier, we expect PR Times to mitigate this risk by implementing a modest increase for the sprinter plan to maximum JPY 39,800, the higher end of competitors’ price points to prevent churns. Moreover, PR Times boasts the largest number of page views, SNS followers and media partners among competitors, and from commercial viewpoints, companies cannot afford to rule it out just because price goes up by dozens of dollars. After all, press release is no longer a press release per se, but an indispensable marketing weapon to grow your business.

*NOT INVESTMENT ADVICE*