M&A Arbitrage with JSR (4185.T)

As rising rates weigh on global equity, TOPIX has extended loss by almost 10% since the September value rally, a drawdown enough to undermine optimism seen until recently around Japanese stocks. Some go as far as to claim that the impending policy normalization by the BoJ will trigger market apocalypse as liquidity evaporates, while others are opportunistically looking out for attractive entry points into high quality value assets in Japan.

Retail investors in Japan who trade on margin are most leveraged today throughout 2023 and suffering from more than 10% of unrealized loss as of October 20. Market capitulation often coincides with portfolio deterioration following a period of inflated investor sentiment, and should TOPIX break “the line”, we cannot omit a possibility of major sell-off. Under such circumstances, the deepest value stocks may not always trade defensively.

Our preferences during market downturn include stocks that are waiting for tender offer to kick off. Japan is in our view the least arbitraged market among developed economies in terms of event driven strategy, and even less so when investors are panic about their unrealized loss and liquidate whatever positions they have to avoid margin violation, or sometimes just to sleep well at night.

JSR Deal

JSR (4185.T) has been waiting for regulatory approvals to effectuate tender offer by Japan Investment Corporation or JIC in short. As the name suggests, JIC is a public investment vehicle funded by the government of Japan to promote Japan’s strategic priorities, involved in a number of deals with national security concerns behind the scene. In June 2023, JIC announced a JPY 900 billion take-private of JSR to bolster its aggressive investment plan and most importantly, catalyze industry consolidation, valuing the company at JPY 4,350 per share, around 35% premium to an unaffected price at JPY 3,234.

However, share price closed at JPY 4,215 the next day after hitting JPY 4,322, followed by another five days of correction down to JPY 4,039. We were closely monitoring the situation back then and concluded that the wide spread from the announced price had been driven by the lesson learnt with Hitachi.

Hitachi Precedent

When Hitachi announced a sale of its listed metal subsidiary in April 2021, the parent was contemplating launch of tender offer by November 2021 after antitrust clearance from relevant authorities. However, the sensitivity around its product lineup such as rare metals caused scrutiny by some countries, resulting in a prolonged delay in regulatory approvals. As such, it was only October 2022, or 11 months later than initially scheduled, when the subsidiary got delisted and its investors were cashed out.

As JSR is a major supplier of semiconductor materials with the largest 26% share in photoresist market, it shares in common with Hitachi Metals geopolitically strategic characteristics that could potentially upset overseas fair trade regulators. While JIC made clear its target to commence tender offer by late December, the precedent with Hitachi allowed for speculation that the deal could also get postponed.

As smart money is always mindful of time-weighted return or IRR and would have chosen to exit given the potentially long waiting time, short JSR offered a good risk-reward back then. However, the takeover spread has since continued to widen to about 9% as of October 26, wide enough to raise a question whether any speculation beyond the schedule delay is being contained or not - namely, chances of the deal falling through.

Deal Breaker

Given the deal is friendly in nature, potential deal breaker really is a cease and desist order from overseas antitrust authorities and in particular, China’s antitrust approval has been pivotal to deal contingency. Some readers may remember that back in 2018, Qualcomm reluctantly terminated NXP deal after failing to obtain China’s antitrust approval. While we strive to remain politically balanced, media reported that China did not rule out the deal - it COULD not rule it out from the antitrust perspectives but prevented the deal from happening by not delivering a concrete ruling until the long stop date of the deal. Qualcomm paid a breakup fee of 2 billion dollars.

China kills Qualcomm's $44 billion deal for NXP

Geopolitical landscape has never been worse than today. Reshoring is a trend driven by the rise of protectionism which spread across the globe and broke it apart into bloc economy. Under such circumstances cannot we completely omit a possibility where a combination of the government affiliated fund and the dominant photoresist maker has to undergo severe scrutiny.

National Mandate

While such speculation sounds persuasive in a VUCA world, we view deal breakup unlikely based on deal profile from the orthodox antitrust viewpoints. For one, JSR is never proposing to merge with Tokyo Ohka Kogyo, the second largest photoresist maker next to JSR, but to go private with JIC as a financial sponsor. Our check into JIC’s portfolio reveals that it has no exposure to other photoresist makers either directly or indirectly, suggesting that the transaction is not disruptive to market competition.

Photoresist Market Share in 2021 (Source: Omdia)

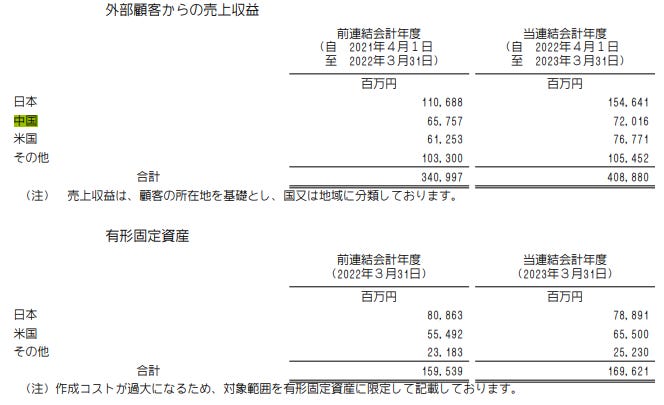

Secondly, we believe that an adverse ruling may potentially happen but unlikely result in deal break. According to the disclosure below, JSR generated about 19% and 18% of total revenue from China in FY21 and FY22, while it does not possess meaningful asset base in the country but in Japan and the US. As such, any potential ruling would not have material adverse effect on deal structure, but at most impact some pocket of revenue in the country which in any way would not deter JIC from pursuing the deal, because it is not so much a private equity investor as a national agency with the primary focus on protecting nation’s strategic assets rather than making good money.

Another potential speculation behind the wide spread, although very unlikely in our view, is deterioration of the target’s fundamentals to the extent which would no longer supports the price announced earlier. Not so long ago, event driven managers were disappointed with the ending of the Toshiba drama where expectation towards tender price had inflated above JPY 5,000 but it ended up at JPY 4,620 on account of base business deterioration. Semiconductor industry is undergoing inventory correction and some names have underperformed significantly since June 2023, but what makes us comfortable is that JSR’s comps have traded resiliently since the announcement and hence, there is little chance of valuation downgrade.

Tactical Short

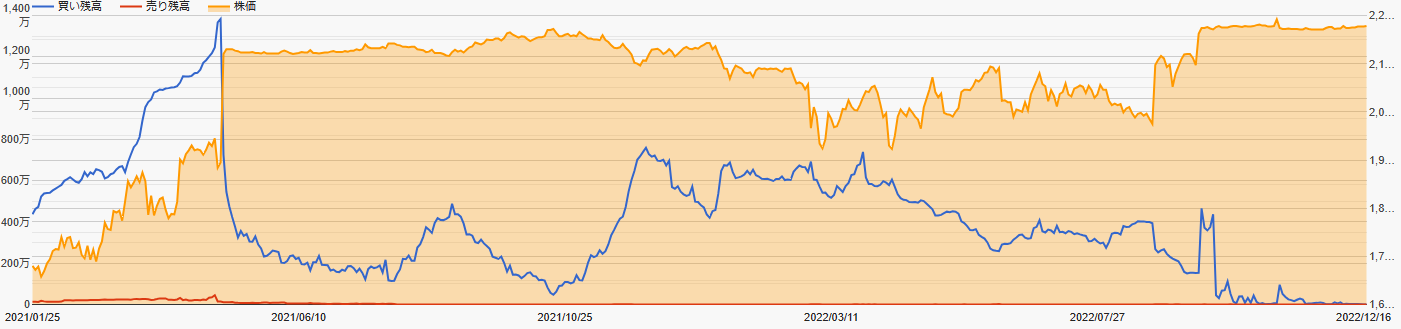

On balance, we believe that the recent dip of share price is not justified by speculation about deal contingency, but more a function of broad-based portfolio liquidation in the middle of bear market. Moreover, it may have been accelerated to some degree by tactical short exploiting vulnerability of leveraged long positions in JSR. A similar strategy was observed for Hitachi Metals share. The chart below shows share price in yellow and long balance on margin in blue, and there was strong and continued flow into Hitachi Metals share which was then sweeped out occasionally. The peak volume of long speculation amounted to 7.6 million shares or total interests of approximately JPY 17 billion when denominatd in the proposed price. This in our view serves as a benchmark for an aggregate amount of risk arbitrage capital that is allocated to one Japanese large-cap buyout with Chinese regulatory exposure.

The balance of leveraged long positions in JSR is approaching 3.7 million shares as of October 26, which implies the total interests of JPY 16 billion already and high time to cover the tactical short. The current takeover spread of about 9% is still much tighter than the peak spread of about 16% for Hitachi Metals, but the gap may be attributed to investor's comfort coming out of the Hitachi precedent rather than implying further downside risk in JSR’s share price.

Conclusion

With the inherently lower breakup risk in the JSR=JIC transaction, we believe the JSR’s current price at JPY 3,960 versus the proposed bid at JPY 4,350 offers a good risk-adjusted return. The way you respond to market downturn shapes your portfolio resiliency. It is worth your time exploring Japanese risk arbirage opportunities to hedge against market systemic risk and pursue absolute return with careful diligence.

*NOT INVESTMENT ADVICE*

Thank you so much for reading my research! If you enjoyed it, please share with your friends and colleagues so that I keep motivated to share more with you! :)