“It feels much hotter than Indonesia“ said a good friend of mine who visited Japan on summer vacation and had just called off an afternoon excursion to Kiyomizu Temple. According to the Japan Meteorological Agency, July 2023 turned out to be the hottest July in the 125 years with the average temperature in Tokyo 3.6 celsius degrees higher than historical average. Seated across the table in an air-conditioned cafe, I recalled what I know about Herzberg’s hygiene factors and worried if the weather these days was sweltering enough to offset his overall satisfaction with my hometown.

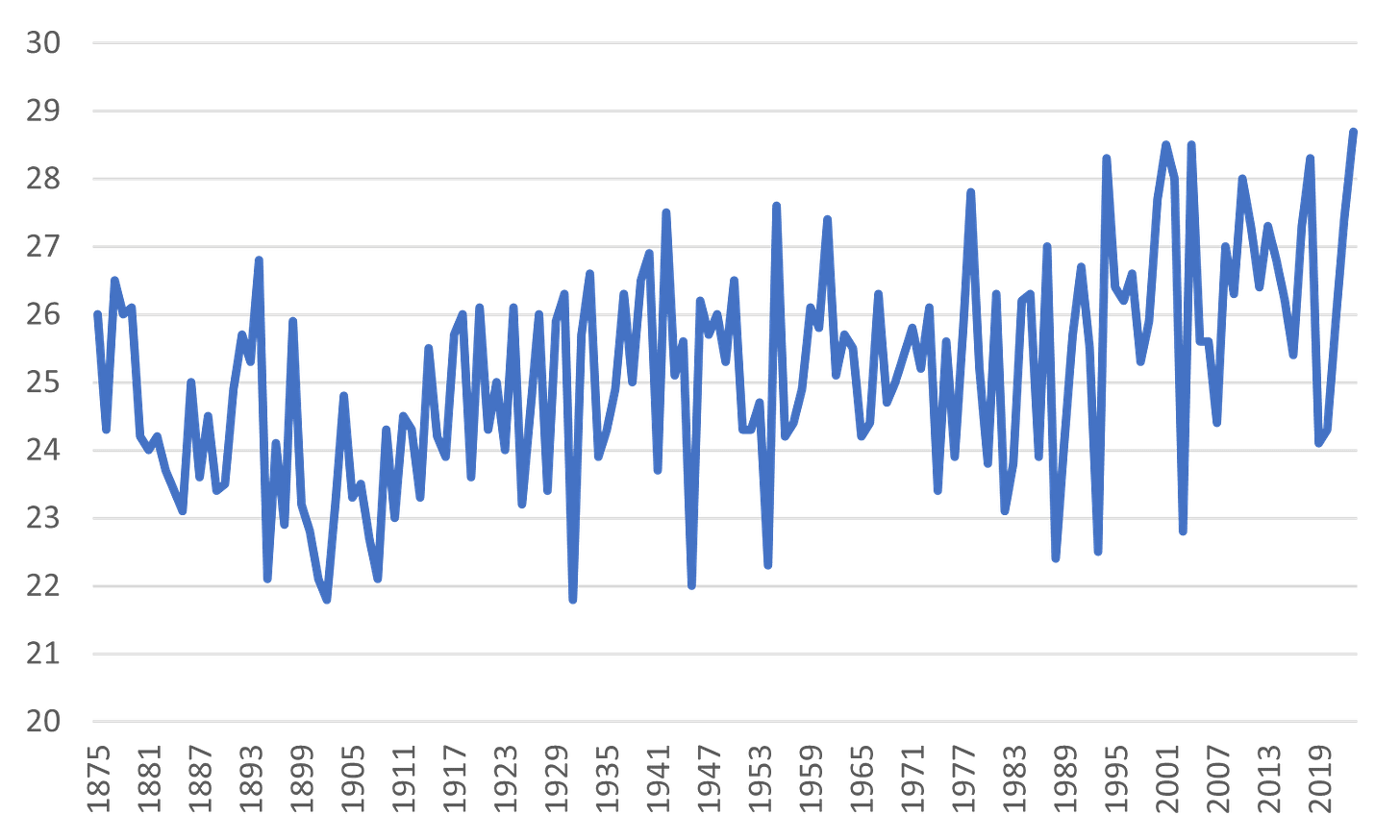

July Average Temperature in Tokyo (Source: Japan Meteorological Agency)

Surprisingly enough, the hot weather has persisted until November and short-sleeve Lacoste polos are still around today. To be fair, Japan is not the only victim of the heat wave but the world is more or less suffering from the global climate phenomenon - El Niño. India, the world’s largest rice exporter, decided to halt non-basmati rice export after Northern rice fields had been severely besieged by drought, creating pressure on international food supply. Wild fires may also cause significant environmental damages including Australian bushfires or Indonesian haze blowing across the neighbor nations.

Uncharged Murderers

Gates Foundation found out in 2016 as part of the World Mosquito Program that mosquitoes kill more humans than human murderers do, with about 725,000 people dead from mosquito-born infections such as Malaria or Dengue. Experts warn that the death toll may rise sharply this year as the hot weather is likely to dry up large bodies of water to form smaller stagnant pools, the ideal breeding ground for mosquitoes as well as other pests.

No wonder pest control has never been so common a topic as this year. Google Trends suggests as below that search for “殺虫剤” or “Pesticides” in Japan remains unusually popular into autumn with an odd spike in September due to a massive outbreak of stink bug across the country. Pesticides would have been taken off the shelves and replaced by either disposable pocket warmers or mineral bath salts about this time every autumn, but retailers seem to expect continued demand for pesticides until the weather cools down.

Search Interest for “殺虫剤” or Pesticides in Japan Based on Google Trends (As of November 4, 2023)

Product Seasonality

Pesticide market in Japan is a virtual oligopoly where more than 90% of the pesticide sales is dominated by Earth (4985.T), Fumakilla (4998.T) and Kincho (private). There is a distinct seasonal feature observed in their sales pattern where -

March: Retailers start to place order ahead of summer season

May to September: Retailers restock depending on actual demand

October onwards: Retailers return unsold goods

My favorite chart below visualizes pesticide’s seasonality, plotting Google search counts for the term “Pesticides“ against the Earth’s quarterly revenue. Majority of the maker’s revenue accrue in the first half of year with the peak demand in the second quarter responsible for their annual revenue volatility. While various factors such as competitive landscape or retailer inventory play out, the search counts which I view as a proxy for consumer demand and actual sell-out from retailers seem to be a leading indicator for retailer’s need to replenish inventory, or in other words, the maker’s revenue.

Quaterly Trends of Pesticide Search and Earth’s Pesticide Revenue

Hot Autumn

A combination of the global warming and El Nino is never a good news for skiing enthusiasts, while it is for pesticide manufacturers. POS data suggests that pesticide sales has spread into autumn in recent years and the trend is even more evident this year with search volume afloat at a considerably high level since September as shown below. I am writing this notes on November 4 and the temperature in Tokyo today is above 25 celsius degrees, marking another record breaking month. Female mosquitoes are burning what little energy they have left to go after our blood so that they can survive winter and reproduce next spring.

日やけ止め、制汗剤、殺虫剤・虫ケア用品、冷却剤、2023年夏物商材の動向振り返る

【速報】東京都心で25.0℃を観測 11月に夏日は14年ぶり 過去最多の夏日日数も更新

Comparison of Weekly Search Volume for Pesticides With Maximum Indexed to 100

While pesticide makers are all expected to benefit from this meteorological tailwind, the degree may vary. As the weather is always treacherous and unpredictable even with state-of-the-art artificial intelligence, an ability to respond swiftly to changing demand is imperative to not only control inventory and goods returned, but also exploit revenue opportunities to the full. Let us explore further to identify which of Earth or Fumakilla is better positioned for hot autumn in Japan.

Late Cyclical

The chart below compares historical quarterly revenues of the two pesticide rivals. This tells us that Earth does not just outsize Fumakilla but it gets a leg up over the competition in the second quarter. The delta in the second quarter signifies different risk appetites of the two players - Fumakilla prioritizes inventory control over revenue upside in the second quarter, while Earth is willing to shore up inventory to make the most of restocking order in summer and residual demand in autumn.

Quarterly Pesticides Revenue in JPY Billion. Earth includes overseas revenue while Fumakilla does not, but the Earth’s overseas revenue is not significant relative to domestic revenue

This answers my question, which popped up in my mind when I visited several drug stores in October, as to why Earth products have at least 5 times higher face share than Fumakilla, while Earth is only 2.3 times larger in revenues than Fumakilla. As Fumakilla ships out most of their products by the peak season, they are already gone as early as late summer. While Fumakilla team head to a wrap-up party at Izakaya in September, Earth team are still staring at the sales data from retailers and weather forecasts into autumn in an effort to take advantage of the white space. As such, hot autumn is likely to reward the hardworking team.

Pesticide Booth at Tsuruha Drug Store on October 30, 2023

War Chest

My argument about their different risk profiles is further supported by their inventory cycle. The chart below compares quarter-on-quarter growth of their inventory, with the peak ramp-up in Q4 for Fumakilla and Q1 for Earth. As pesticides are not year-round products, revenue opportunities are governed by inventory cycle and this time around, an Earth’s late cyclical profile relative to Fumakilla is likely to bear more fruit.

QoQ Inventory Growth

In addition to the late cyclical profile, competitive environments are another tailwind for Earth. The rival somehow downsized inventory in Q1 as highlighted in a red circle above as opposed to the past practice by which Q1 inventory growth is normally in positive territory. As a result, Earth had war chest worth 4.65 months of peak revenues versus 3.85 months for Fumakilla as shown below. For those who might have frown disapprovingly at the recent inventory build-up, it only looks like so because summer started later than usual in 2022 and 2023 leading to a delay in shipment beyond the cut-off date for this data. Hence, key takeaway from this comparison is not about the relative size to revenue but about the delta that gives Earth more white space to fill in.

Inventory Months Ahead of Peak Season

Margin of Safety

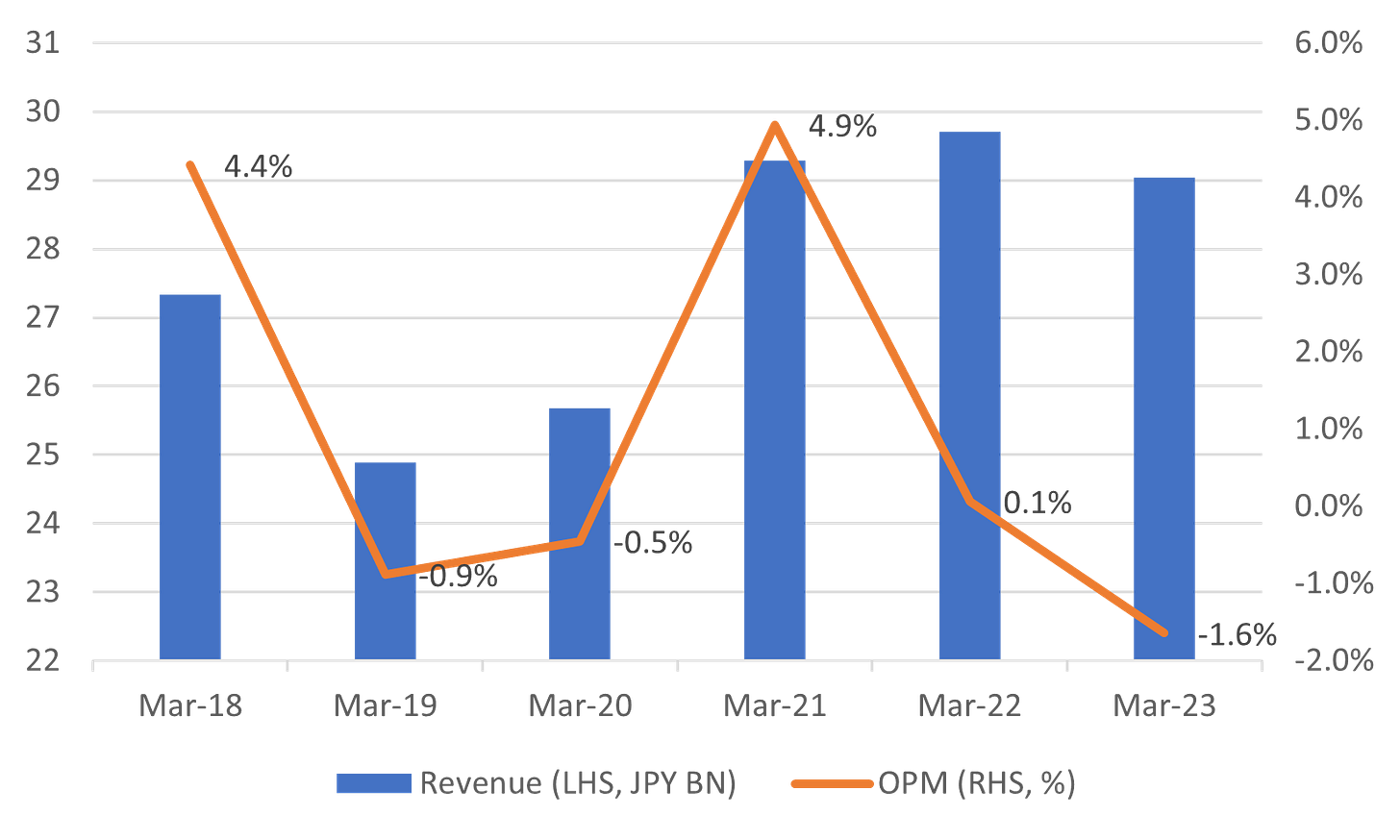

You can deepen your understanding of the industry dynamics by getting to the bottom of why in the first place Fumakilla had to downsize inventory in Q1. As discussed earlier, the inventory contraction was counter cyclical and may have limited its ability to benefit from hot autumn. As the chart below shows, operating margin of its domestic business has significantly worsened since 2022 due to higher oil prices. This is because pesticides are entirely made from oil - pynamin forte for ingredient, aerosol for spray and plastic for container. Weak yen also coincided and eroded gross margin by 2.2% versus 2021, putting more pressure on inventory discipline to contain further loss. While there is no official account behind the cutback, deteriorating margin necessitated production adjustment in my view.

Fumakilla: Historical Performance of Domestic Pesticide Business

Isn’t Earth also suffering from the same cost pressure? That is a reasonable question, the answer to which sheds light on fundamental strength with Earth over Fumakilla. Earth has been successful in launching new products at higher price points, for example, “Mamo-room” that spreads ultra-micro pesticidal ingredients with flavors. This has sold way better than plan according to the company and enhanced blended gross margin. On the other hand, Fumakilla has struggled to generate revenues from new products, which account for shy of 15% of the total revenue in 2023 as below. In other words, Fumakilla relies on legacy products with lower price points and has been unable to pass the increased cost onto prices. On balance, Earth’s superior product development capabilities give it an extra margin of safety about inventory expansion amid uncertainty.

Fumakilla: % of Revenues from New Products

In or Out

Despite Earth’s strong execution, however, investors have been vigilant so far since its Q2 earnings. Earth revealed that there was a 7% miss versus plan in the sales volume of the products it had implemented price increase for in early 2023. Investors were caught by surprise as one of the analysts had confirmed with the company last year that pesticides have lower price elasticity in nature. Earth executed another price adjustment in September, leaving investors cautious about further volume decline.

However, simulating retailer inventory provides a new perspective on this matter. The chart below compares “pesticide” search trends by year as a proxy for end demand, which hovered in low gear this year until mid June. The peak demand during summer season was also delayed by a month to the beginning of July. In my view, the slow start of consumer demand or “sell-out” this year pushed back retailer inventory replenishment or “sell-in” beyond Q2, explaining the 7% volume contraction in Q2.

Comparison of “Pesticides” Search Trends

Interestingly, Earth did not conclude either that the volume decline resulted from share loss due to price competition. POS data actually suggests that Earth marginally increased market share from 56.4% last year to 57.3%. Given Fumakilla’s revenues also shrank in Q2, it is more persuasive to argue that the Q2 volume decline was just a sign that slow summer rolled over part of the maker’s sales from Q2 to Q3.

Surprise Beat

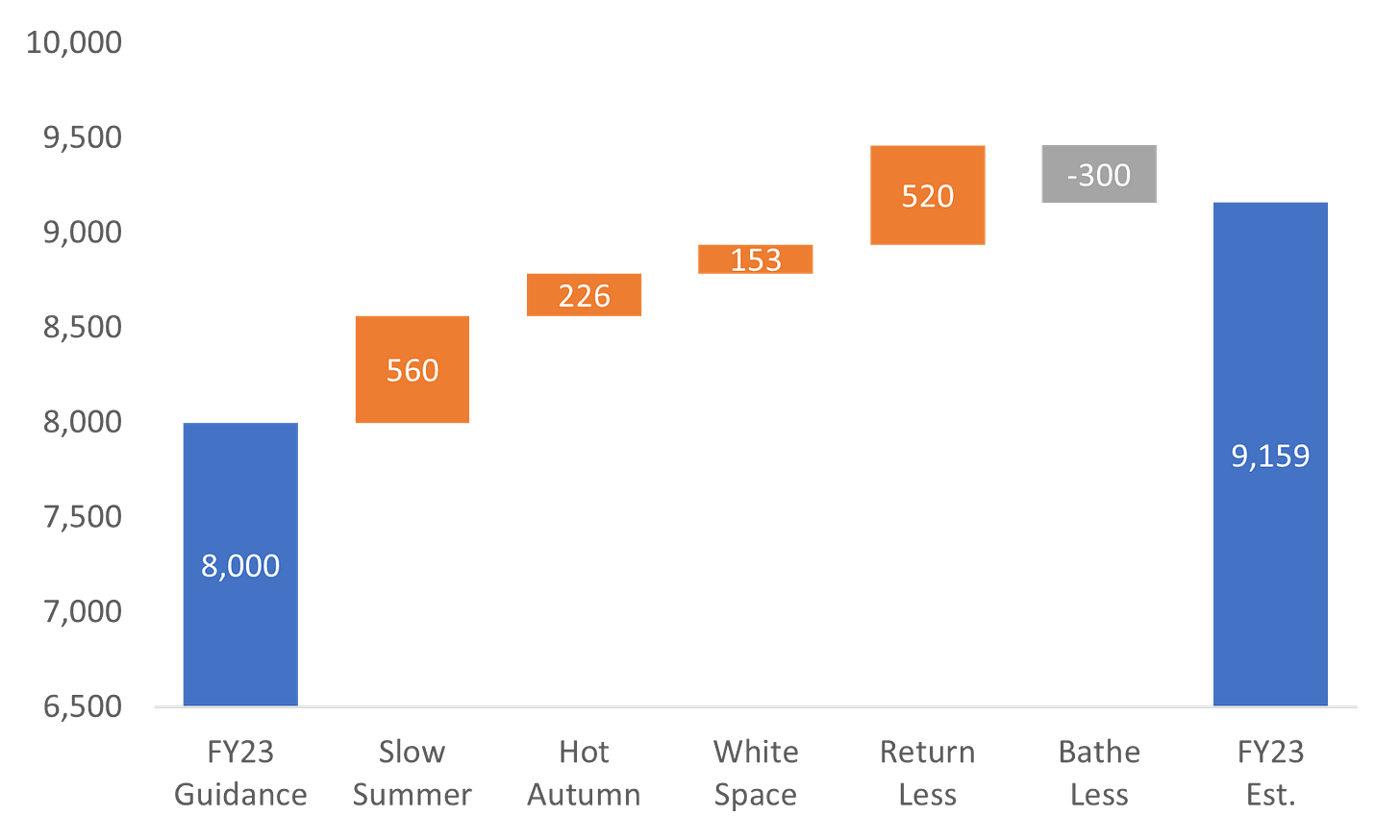

So far we have covered enough contexts to discuss the operating profit bridge below. Despite the 1H miss, Earth maintained its FY23 operating profit guidance at JPY 8BN that investors do not seem to buy as share price has dropped by around 3% since the last earnings. Based on our discussions so far, however, Earth is expected to deliver a 15% surprise beat in FY23 operating profit based on my estimate.

Earth: FY23 Operating Profit Bridge in JPY Million

Slow Summer: Retailer inventory restocking delayed from Q2 to Q3 owing to slow summer. Calculated based on various figures from the company’s disclosure

Hot Autumn: Increased demand during September to November due to the high temperature. Calculated based on historical correlations between search trends and pesticide revenues

White Space: Disproportionate revenue upside stemming from the late cyclical revenue exposure and larger war chest compared with its rival. Calculated based on high-level retailer/maker inventory model

Return Less: Low rate of goods returned thanks to extended period of summer season. Calculated based on 4.0% return rate versus 4.8% in FY20, the latest available figure

In order to smooth out seasonality with pesticides, Earth has diversified business portfolio into other lines of business including Oral Care, Bath Salts, Pet Care and Others. These are all consumer staple products and historically less volatile, therefore not expected to move the needle except Bath Salts. As much as Japanese people cannot do with bathing regardless of season, the bath salts sales typically goes up significantly in winter and is likely to experience negative impact from hot autumn this year.

The Worst is Behind

Whether this potential investment ends up short-lived or long-lived depends on input price trends. Earth imports raw materials in bulk every November or half a year ahead of the peak season, and disclosed that weak yen and higher oil combined had resulted in cost increase by JPY 5.2 billion over the past 2 years. CNYJPY and WTI was trading at around 20.5 and $90/bbl respectively back in November 2022, and normalization of these trading terms, if not full, would be tremendous tailwind for Earth as cost decreases while prices likely remain.

It is worth noting that we have started to hear good news. Despite resilient oil prices, petrochemical material prices have declined due to fierce competition where for example, Sumitomo Chemical whom pesticide makers buy ingredients from wrote off the Essential Chemical segment a few days ago. Also, Earth announced a new initiative to smooth out raw material procurement to keep margin under control. With these positive developments in mind, I am inclined to make a call that the worst is already behind.

Looking Forward

Slow summer and hot autumn will not only bring about a surprise beat against bearish consensus, but also remind investors of its superior market positioning against peers. The FY23 beat alone warrants a 15% upside potential on a constant multiple basis, implying an IRR of >50% if realized post Q4 earnings.

Furthermore, this stock has a potential to become a top pick among petrochemical manufacturers in the middle of what I call “cost normalization trades” if input cost finally starts to fall, given its lead in competitive pricing, disciplined cost control and superior product development. We have seen similar trades play out with consumer retails, Aeon as a prime example, successful in price execution followed by strong cost containment and normalization. Under such circumstances, investors would anchor expectation around the normalized operating profit of JPY 12-14 billion as below, implying up to 55% upside as earnings go up by ~1.7x and multiple normalizes from 20x to 15x.

Earth: Normalized Operating Profit in JPY Million

The investment risks include further upside in crude oil prices and USDJPY as well as warm winter that keeps people away from bathing and results in low bath salt sales. As I keep tabs on this idea going forward, please subscribe for free from the link below to receive updates and other new ideas. Share my work to keep me motivated. Thank you!

*NOT INVESTMENT ADVICE*