Cherry blossoms or Sakura in Japanese bloom in April, my most favorite season were it not for notorious hay fevers that just get worse every year. I suffered from pollen allergies in Japan so much that I would rather take air pollution in Hong Kong now, but I still cannot help but feel a pang of nostalgia for my hometown every spring when my family share pictures of Sakura in full bloom.

However, I am feeling much better now because I just had my investment in Sakura bloom - Sakura Internet (3778.T). Share price has been up by 58% over the past 2 days after it had been selected as a national cloud DC vendor. While I update my model over night, I would like to share my recent write-up on Sakura Internet as of August 2023 so that you could overview investment perspectives around this stock. Please feel free to reach out on Twitter if you want to receive the underlying model.

Executive Summary

This paper recommends investment in Sakura Internet (3778.T, “Sakura”) that operates data center and cloud services in Japan. Sakura is well positioned to capture ample revenue opportunities around the government cloud and AI servers, with the base case assuming revenue growth at a 16.8% CAGR towards FY27/3 and OPM improvement from 5.3% in FY23/3 to 10.8% in FY27/3. Assuming a 3-year holding period with an exit multiple of 30x forward P/E, the investment yields a 19.4% IRR with target price at 2,111 versus 1,240 as of Aug 25th 2023.

While much attention is paid to Sakura’s investment plan in AI servers alongside the government, key debates also include whether Sakura can meet requirements to participate in the government cloud program this year as that would catalyze further adoption of Sakura’s cloud infrastructure among private sector and allow it to grow in line with the fast-growing cloud services market. At the same time, failure to register as the government’s cloud provider this year would signal an immediate exit from the investment.

Company Overview

Sakura engages in data center operation and cloud services in Japan. Since founded in 1999, Sakura has been a leading data center operator with a proven track record of 20-year uninterrupted revenue growth. The growth experienced a hiccup in FY22/3 when it underwent drastic transition from hosting services to cloud services, while the overhaul repositioned it to benefit from the fast growth of cloud services market. Revenue from cloud services (“Cloud DC”) grew from 6.4BN (~29% of total revenue) in FY21/3 to 8.0BN (~39%) in FY23/3, while that from the legacy hosting services (“Legacy DC”) dropped from 6.2BN (~30%) to 3.6BN (~18%) during the transition.

Apart from the DC business, Sakura also provides clients with cloud-based software solutions (“Cloud App”) or SaaS to support their digital transformation. For example, it partnered with Yamato, the Japan’s largest last-one-mile company, to develop a SaaS application to allow senders or recipients to arrange pick-up or delivery at their preferred location and time. Sakura is clearly differentiated from traditional IT vendors as the cloud infrastructure allows partners to pay as they go instead of taking greater risk of capex. In FY23/3, the Cloud App segment recorded 3.8 BN (~19%) in revenue, around a half of the Cloud DC segment. The rest of revenue comes from ~10 subsidiaries (“Others”) with details unknown. The historical revenues are found below with each bar denoting Cloud DC, Cloud App, Legacy DC and Others from the bottom.

Sakura leases 4 data centers in metropolitan areas and owns 1 in Hokkaido. The one in Hokkaido is an attractive and strategic asset for the following two reasons. Firstly, clients started to look out for data centers in suburb areas as a utilization rate of data centers in metropolitan areas stay elevated near 90% in Japan1. The asset is one of the largest data centers outside metropolitan areas in Japan, boasting a maximum capacity of 6,800 racks. The model implies the current utilization rate is just shy of ~40%, leaving adequate room to pursue scale from the capacity perspectives. Secondly, the asset is attracting increasing interests from environmentally aware clients as it utilizes the cool air in Hokkaido to replace air conditioners, reducing electricity consumption by 40% compared with metropolitan data centers and PUE down to 1.11 throughout year2.

Industry Overview

The amount of data is growing exponentially, driving strong and sustained demand for data center. While cloud has been an increasingly popular choice in Japan, the cloud infrastructure i.e. IaaS/PaaS is a virtual oligopoly with the US cloud giants i.e. AWS, Azure and IBM commanding a ~75% market share. Historically, IT vendors such as NEC, Fujitsu or NTT Data developed data centers to host clients’ servers as part of their value chain from consulting, system development, operation and maintenance, but their presence gradually declined amid the cloud shift. Instead, pure data center operators have emerged to lease computing resources to the US cloud services such as AWS or Azure. Overall, the cloud infrastructure market is expected to grow at a ~13% CAGR towards 2026 in tandem with the other segments of cloud services such as SaaS.

The cloud infrastructure market is attractive but not easy to enter. As is often the case for technology sectors, cloud providers also have to go through consumerization to improve security, accessibility, and most importantly, scalability to gain pricing power. While Japanese IT vendors keep focused on enterprise system, Sakura is a challenger with consumer-oriented public cloud offerings.

There are two remarkable disruptions that favor Sakura’s endeavor to gain share in the cloud services market in Japan. One is the government cloud program in which it plans to relocate IT infrastructure to cloud by 2026, creating a 250BN blue ocean. While this has not been pronounced explicitly, the government expects domestic cloud services providers to catch up with the US giants and participate in the program as soon as practically possible due to the fact that the Japan’s trade deficit has been widening not just because of the weakening yen or energy price inflation but also its utter reliance on the US giants for cloud computing resources. It was reported in Aug 2023 that the government conducted reviews of requirements that essentially lowers the hurdle for domestic companies to take part in the program3.

The other disruption to the cloud services market is AI servers that are projected to grow at a 2022-2026 CAGR of 29% and constitute 15% of the total server shipments4. The restrained GPU supply has caused the chip price to soar, potentially resulting in a situation where only the US giants with scale can afford them and other countries fall behind in terms of AI technology advancement. Against this backdrop, the government of Japan launched initiatives to subsidize private companies to procure GPUs and so far, applications from Sakura and Softbank have been approved.

Investment Thesis

Thesis 1: First Mover Advantages with AI Servers

Sakura announced a plan in Jun 2023 to invest 13BN in AI servers with 2,000 units of the latest NVIDIA H100 chips (“Hoppers”), half of which is subsidized by the government with an aim to promote AI technologies in Japan5. Sakura is among the first movers in Japan to deploy the Hoppers in a large scale, allowing it to benefit disproportionately from the fast-growing AI server market which is estimated to grow at a CAGR of 29% towards 2026. Sakura was able to move fast as it has a plenty of unused capacity in its largest DC in Hokkaido, while other DC operators in Japan have collectively seen a utilization rate of near 90% in recent years. Sakura’s excess capacity creates an immediate advantage to correspond to the growing demand for AI servers and scale and optimize the operation by the time competitors catch up. Also, Hoppers is sought after by tech companies around the word and reportedly, sold out until 20246. Apparently, it would take at least a few more quarters or longer for competitors to be able to deploy the chips in a meaningful scale in Japan, giving Sakura more time to enjoy the disproportionate benefit from the emerging AI server market.

The anecdotal evidence for the Sakura’s first-mover advantages is that it announced significant acceleration of the investment plan in Aug 2023 given the increasing interests from 50+ companies since the initial announcement of the plan in Jun 2023. This allows Sakura to scale operation at a much faster pace than anticipated, leading to strong pricing power over competitors even after GPU shortage eases. It is also notable that the government subsidy significantly lowers break-even for Sakura, reinforcing the competitive pricing power.

The table below illustrates the investment plan and revenue projection. The plan suggests an accelerated deployment of AI servers by Sep 2024 and implies deployment cost per GPU at 6.5MN. Utilization rate is assumed at 70% after service launch scheduled in Jan 2024, balancing high demand and extra capacity saved for sprint uses. Rates are assumed at 300,000 per month, about 50% premium to the incumbent models i.e. A100 or V1007, and also in line with pricing at AWS Lambda that ranges between USD 1.89/H100/hour for 3-year minimum lease and USD 4.85/H100/hour for sprint uses8. These preliminary assumptions imply Sakura’s revenue potential of up to 5BN in FY25/3.

Thesis 2: Entry to Government Cloud

Sakura is also motivated to join the government cloud program in which the government is relocating IT infrastructure onto cloud in order to reduce cost, standardize data formats across different offices, and increase accessibility from the general public. The transition plans to complete in 2026 and is expected to emerge as a 250 BN market by then9. Given sensitivity of the data, the program requires vendors to meet strict security specifications called ISMAP, and there are only two certified vendors today – AWS and GCP. This is in fact alarming for the government as oligopoly by foreign vendors means widening of the trade deficit, and thus domestic vendors including Sakura are called upon to catch up. Some domestic vendors including Sakura have already fulfilled ISMAP requirements and may apply for this October’s solicitation by the government.

While details of the October solicitation are unknown yet, chances of Sakura being selected as the first or one of the first national vendors this year would be fairly high. Sakura set up an internal team named Government Cloud Department as early as Apr 2022, frontloading marketing and business development according to interviews with team10. The CEO reinforces its strong focus on this domain whenever he appears in the media and implies potential participation for the program this year. It also has close working relationships with the government, for instance, building cloud platform to allow the private sector to access data from the government-operated satellites.

From capabilities’ perspectives, Sakura has a differentiated track record of operating public cloud – while domestic competitors such as NEC, Fujitsu or NTT Data are specialized in large enterprise system on premise, Sakura is one of the few domestic public cloud operators which onboards a galaxy of SME businesses to run consistently in any environment with containerization technologies. In that sense, Sakura has similar capabilities to AWS or Azure rather than the domestic competitors, implying high potential to serve the needs of the government for secure, scalable, and consistent platform.

Speaking of the addressable market, the CEO commented in an interview that while the majority of the 250BN market is dominated by the US cloud giants, Sakura is focused on specialized areas such as CDN, GPU and so on to eat into the market and take a 10~20% share that translates to a 25~50BN revenue. As elaborated in the Investment Risk later, however, a lack of human resources may restrict the ability to scale at such a rapid pace and it would be difficult to believe in the target at least before confirming some tractions. While progress needs to be observed and assessed, the model assumes conservatively that Sakura will address up to 2.5% of the total market towards the end of FY27/3, generating about 5BN in revenue.

Thesis 3: Margin Improvement and Robust Cash Flow

Cloud is in nature a lucrative business compared with traditional hosting services, as the former is essentially software technologies that are highly scalable while the latter is hardware leasing business. As a result of the ongoing cloud shift and revenue expansion, Sakura is likely to improve margin which can further accelerate investment in the cloud domain. There are two major factors to drive margin improvement – one is operating leverage and the other is mix shift;

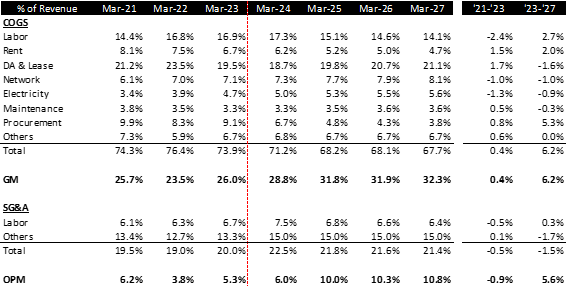

Operating Leverage

Labor cost is likely to increase in the near-term due to headcount increase, but gradually decline as a % of revenue as operation is scaled

Rent has so far been optimized as a result of remote working prevailing for 90%, and is modeled to increase parallel to FTEs

DA & Lease would jump if it were not for the government’s subsidy – the subsidy amount is deducted from book value of the acquired assets, leading to reduced depreciation and gross margin improvement from P/L perspectives. As a result, DA & Lease as a % of revenue is expected to plateau at around 20%

The mix shift towards cloud is expected to cause the associated costs such as Network, Electricity or Maintenance to increase and Procurement which is apparently correlated to the Others segment to decrease as a % of total revenue, overall leading to gross margin improvement.

In addition to the government subsidy, Sakura’s healthy balance sheet and improved cash conversion will also bolster the aggressive capex. Sakura has de-levered operation over the last few years, and the debt-to-equity ratio and debt-to-cash-profit was 1.0x and 1.8x respectively as of FY23/3, leaving room for levering up. Also, the working capital is released as revenues expand as Sakura receives prepayment that amounts to one fourth of annual revenues. These conditions favor Sakura, allowing it to finance the planned capex without new share issues. Furthermore, the margin improvement and high capital efficiency would more than double ROE up to 18.2% at the end of the projection period.

Investment Risk

Risk 1: Talent Shortage

Despite the ample revenue opportunities, Sakura may not be able to unlock all of them as a result of talent shortage. It increased FTEs from 718 to 786 over the last twelve months and budgeted another 100 headcounts in this fiscal year, but it is still uncertain whether new hires can get up to speed to address the rapidly growing demand. Agility is a key particularly to the government cloud business as its cloud shift is mandated to complete by 2026 and a hurdle for gaining market share would be higher after 2026 as public clients are by and large sticker than private sector.

As such, the base case takes this risk into consideration by assuming a rather modest share gain in the government cloud market up to 2.5% in contrast to the scenario in which the CEO envisions a 10~20% market share. While the gap needs to be addressed as the company reports progress down the road, the 2.5% market share would be a comfortable target at this moment to not only stay conservative but also consider Sakura’s superior positioning and growth potential to a reasonable degree. This assumption implies revenue per employee to increase by 31% in the projection period, which is not too aggressive given the majority of revenues are recurring and sales team can always focus on new businesses.

Risk 2: Disillusionment of Generative AI

Sakura made decisions to accelerate the investment plan in response to increasing interests in AI servers from 50+ clients, which may potentially end up with disillusionment in the near-term and lower utilization rates. In Aug 2023, Gartner published a report, “Hype Cycle for Emerging Technologies, 2023”, which placed generative AI on the peak of inflated expectations11. This hype cycle suggests that like Web3, NFT or metaverse, generative AI may have to go through a period of disillusionment before bringing in transformational benefits to business and society. Also, the latest guidance from Snowflake in Aug 2023, for example, suggests restrained outlook on slower software demand, claiming companies are still cautious about expanding their cloud software budget12. These may combine to cause demand pullback and lower utilization rates.

The fact that Sakura plays both a DC operator role and a cloud provider role may mitigate this risk by allowing it to keep informed of client demand and reflect that to the investment plan immediately. This prevents it from overinvestment, and is an advantage over the US mega cloud providers which lease data centers in Japan.

Risk 3: High Expectation From Market

When Sakura announced its plan in Jun 2023 to invest in Hoppers alongside the government, share price skyrocketed from 706 to 1,750 by nearly 150%, followed by painful correction to 922 during the following two months. As of Aug 25th 2023, it is trading at 1,240 or 53.6x forward P/E, representing market’s persistent high expectation and leaving the stock vulnerable to negative pieces of news.

One potential disappointment that could lead to significant multiple contraction would be failure to participate in the government cloud program in Oct 2023. It would not only have material impacts to business plan given the solicitation happens once a year, but also strike potential clients that Sakura’s cloud infrastructure is not up to standard, undermining expectations for the overarching cloud story.

Another potential disappointment would be FY24/3 results. Sakura started to trade ~9% lower on the day after its Q1 announcements, as OP progress versus last year’s guidance was perceived negatively. The lower margin should not have been surprising given it had already announced headcount increase and marketing spend uplift in the last quarter, but it is more of a question whether Sakura can add new businesses towards 2H to gain operating leverage against such fixed costs. While Sakura must have baked in new revenue opportunities with the government cloud from 2H to the guidance, the Q1 softness in Cloud DC revenue, 9.8% YoY vs 10%+ in the last few quarters, worries investors about Sakura’s execution capabilities to grow at 16.6% in this fiscal year.

On balance, while the first disappointment would signal an immediate exit from the investment, the second one may in fact provide another entry point so long as some tractions are confirmed.

Financial Projection

While the Private Sector segment continues to grow in line with the historical, the Public Sector segment (i.e. the government cloud) and the AI Server segment are driving the revenue growth as described in the investment theses. The Cloud App segment is assumed to grow at a faster pace than the last few years, taking into account the recent tractions of adding revenue sharing partnerships. The Legacy DC segment continues to shrink as clients are switching to cloud infrastructure. As details are unknown about the Others segment, it is conservatively assumed to grow at modest rates. Overall, the model implies a rapid revenue growth of 16.8% towards FY27/3 given strong policy and AI tailwinds.

As discussed in the investment theses, Sakura is expected to benefit from margin expansion thanks to operating leverage and mix shift. A P/L summary is shown below.

Return Analysis

As of Aug 25th 2023, Sakura is trading at 53.6x forward P/E which compares to an average of 19.8x among domestic data center peers. While they are mainly engaged in enterprise system and thus not exactly direct comps to Sakura, it would be insightful to compare their margins, capital efficiency, and growth profile to evaluate an appropriate range of multiple for Sakura. Given it is achieving a high-teen ROE and low-teen revenue growth and operating margin in FY27/3, it would rank slightly higher than IIJ and NRI and thus deserve a P/E of 30x or up. This would be a fairly comfortable bottom line considering the fact that Sakura is exposed to public cloud services market which is expected to grow at a CAGR of 12.7% towards 2026.

Revenue growth rates are preliminarily assumed to plateau at a low-teen CAGR after FY27/3 when the government cloud shift completes. Assuming an exit before that or a 3-year holding period from now, an exit multiple of 30x forward P/E implies the target price of 2,111 versus 1,240, yielding an IRR of 19.4%. Also, four assumptions below are sensitized to incorporate various scenarios discussed across this paper and evaluate upside case and downside case.

Government Cloud Market Share: As discussed in the first Investment Risk, whether Sakura can take a meaningful market share in the government cloud market remains to be seen. While base case assumes a linear share gain to 2.5% towards 2027, upside case and downside case assume 4% and 1.75% respectively

GPU Utilization Rate: As discussed in the second Investment Risk, AI may experience temporary disillusionment and be downplayed amid recessionary environment. While base case assumes a 70% utilization rate, downside case assumes lower utilization rates for the first year

Private Sector Revenue Growth: If the downside risks above play out, it would also have negative impacts to the Private Sector as well and prevent Sakura from growing in line with the market. While base case assumes Sakura to gradually catch up with the market growth rate at 12.7%, downside case assumes muted growth rates at 10% to prevail

Exit Multiple: Upside case assumes a higher exit multiple at a 35x forward P/E given the higher growth profile, while downside case assumes multiple contraction down to 20x